Finterion Trading Statistics

Different types of statistics are used to track the performance of a trading bot on the platform.

In this article we will explain how you can read bot metrics on every algorithm page. We will do so by showing you screenshots of metrics of an example bot. We will use the example bot to explain how you can interpret those metrics. The metrics we use in the example are only specific to the example bot as part of this tutorial, and do not represent every bot on Finterion.

What is a trade on Finterion?

On Finterion a trade is a transaction that is executed by an investing algorithm. A trade encompasses both a purchase (buy order) and a sale (sell order), which are executed by the bot on the connected broker. The trade cycle completes when a buy order is succeeded by a sell order.

The outcome of a trade can result in a profit (positive) or loss (negative):

-

A positive trade is a transaction that results in profit. This occurs when the sell order sells an asset at a higher price than the preceding buy order.

-

Conversely, a negative trade is a transaction that results in a loss. This happens when the sell order sells an asset at a lower price than the purchase price in the preceding buy order.

Bot Overview Metrics

The following metrics give you an overview the overall performance of the bot:

- Bot Status

- Total Portfolio

- Growth 1 year

- Profit

Bot Status

The status of the bot and its last check-in time.

In the example we can see that the bot is live, and this means that the bot currently is trading in real-time.

Total Portfolio

The total portfolio graph shows the performance of the bot in the past day, week, month, or year. The total portfolio is the amount in currency that the bot is trading.

The current value of the portfolio of the example bot is 1118.29 EUR.

Growth 1 Year

The total growth in the past year of the trades that bot has executed. The growth of the portfolio is calculated by the net gain as a percentage of the total size of all trades in the portfolio over the last year. If the bot has not been live for 1 year, we will calculate this since the launch of the bot on the platform.

The portfolio has grown by +0,96% over the past year, which is in this case 118.40 EUR.

Profit

The total profit the bot has traded over its history since its launch on Finterion. Profit is calculated by taking all closed trades and calculating the net gain as a percentage of the total cost of a trade. The profit is calculated over the entire lifespan of the portfolio.

The profit made from trades, by the example bot, is 56,74 EUR. This is the net gain after subtracting all losses and expenses from the total revenue.

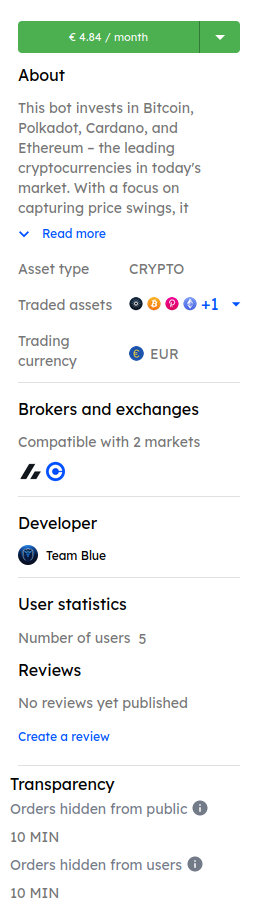

About the Bot

In this section you can find more specifics about this bot and the current usage.

Price

The price of the algorithm is determined by the bot developer. The billing can be, for example, monthly or weekly.

This bot is billed at 4.84 EUR per month. This means it must be renewed if you want to continue to use it after that month.

About

Here the developer can write a few lines about their bot.

This trading strategy is designed to take advantage of short-term market fluctuations. It employs a variety of indicators to identify the lowest point of a specific cryptocurrency. For each cryptocurrency, it checks if the Relative Strength Index (RSI) falls below a certain limit in conjunction with a set of moving averages. If the RSI of a previously purchased coin exceeds a certain limit, it closes the position. This strategy aims to seize potential profit opportunities while managing risk through specified conditions and frequency constraints.

Asset Type

The asset type this bot trades.

The asset type for this strategy is Cryptocurrency (CRYPTO).

Traded Assets

These are the assets that the bot can, not must, trade in. The bot may only invest in some of these assets if the other assets do not meet the conditions set in the bot strategy.

This bot can trade ADA (Cardano), BTC (Bitcoin), DOT (Polkadot), ETH (Ethereum), SOL (Solana), and XRP (Ripple).

Trading Currency

The trading symbol, or trading currency, is the currency the bot executes the trades in.

The trading currency used in this strategy is Euro (EUR).

Brokers and Exchanges

These are the brokers and exchanges this bot is compatible with. Some bots may not be compatible for some brokers and exchanges.

This strategy is compatible with two different markets: Bitvavo and Coinbase.

Developer

This lists the developer of the bot. Clicking on the name of the developer leads you to their developer storefront where you can explore the about section of the developer, their social links as well as other bots this developer has released on Finterion.

The developer of this strategy is called Team Blue and has chosen to remain anonymous.

User Statistics

User statistics gives insight into the usage of this bot by other Finterion users. The Number of Users is the amount of users that currently leverage this bot.

Currently, this strategy is being used by five users.

Reviews

Here other users of this bot can place a review. We verify whether the reviewer has actually used this bot to ensure the quality of the review.

There are no published reviews for this strategy yet.

Transparency

When a trading bot makes an order, we hide the order for a set number of minutes to prevent others copying of the strategy.

Orders are hidden from the public for 10 minutes and are also hidden from users for the same duration.

Which Trading Statistics does Finterion track?

On the algorithm page you can find the following sections:

- Trade Profile

- Algorithm profile

- Portfolio size

- Position metrics

- Trade volume

- Portfolio composition

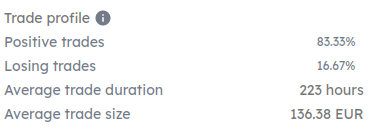

What is a Trade Profile?

The trade profile section contains statistics about the trading bot. The overview shows the percentage of positive trades and losing trades. It also shows the average trade duration and the average trade size.

- Positive Trades: The percentage of trades that were positive out of all trades the bot executed. The higher the percentage, the greater the number of profitable trades executed by the bot. The percentage is in proportion to all trades that this bot executed for all its users for the entire time the bot has been available on the platform.

In the example image we can see that 83.33% of the trades have resulted in a profit.

- Losing Trades: The percentage of trades that were negative out of all trades the algorithm executed.

In the image we can see that 16.67% of the trades have resulted in a loss.

- Average Trade Duration: The number of minutes the algorithm took to execute a trade.

Looking at the example, we can interpret that for this specific bot each trade, on average, took 223 hours.

- Average Trade Size: The average size of the trade in Euros. The higher the number, the bigger the executed trade measured in Euros.

The average amount of money involved in each trade for this bot was 136.38 EUR.

What is an Algorithm Profile?

The algorithm profile gives you insight into the trading symbol which is the traded currency, the number of users and the risk factor of the algorithm you are looking at.

- Trading Symbol: The currency the algorithm trades in. If the currency differs from your local currency, currency exchange fees might apply at your local broker.

The currency used by this bot for trading is Euro (EUR).

- Risk Factor: Trading with cryptocurrencies is always regarded as a high-risk activity. This metric shows the volatility of the particular algorithm and its results. The risk factor of the trading algorithm can range from low to high.

This bot has an average risk factor.

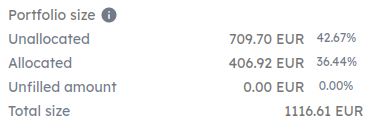

What is the Portfolio Size?

The portfolio is all the trades the bot is currently executing. These are orders that are currently in transit, this means these are buy orders and have not been completed with a sell order yet.

- Unallocated: How much money the algorithm can trade until it is at maximum capacity. Reflected in Euro and percentage until maximum capacity.

Unallocated: 709.70 EUR (42.67% of the total portfolio) is not currently invested in any assets.

- Allocated: How much money the algorithm currently trades. Reflected in Euro and percentage until maximum capacity.

Allocated: 406.92 EUR (36.44% of the total portfolio) is currently invested in assets.

- Unfulfilled Amount: Orders that are currently in transit. Reflected in Euro and percentage of the portfolio that is in transit. In transit are orders that have been made but not executed yet.

Unfilled Amount: There is no unfilled amount in the portfolio, i.e., 0.00 EUR (0.00% of the total portfolio).

- Total Size: Current total worth of the bot's portfolio.

Total Size: The total size of the portfolio is 1116.61 EUR.

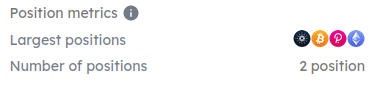

What are Position Metrics?

A position is the amount of a specific asset within the bot's portfolio.

- Largest Positions: The largest positions in percentage of the total portfolio.

The largest positions in the current portfolio of this bot are ADA (Cardano), BTC (Bitcoin), DOT (Polkadot) and ETH (Ethereum).

- Number of Positions:

This bot currently has 2 positions.

What are Trade Volumes?

The trade volume is the total amount of the asset that has been bought or sold.

- Number of Trades: Total number of trades the bot has executed since it was launched on Finterion. A trade is comprised of a buy and sell order on the connected broker.

There have been 12 orders placed by this bot in total.

- Trade Volume: Accumulation of all trades the bot has executed. Noted in the trading symbol.

The trading symbol for this trade is Euro (EUR) and hence the total volume of trades made by this bot is 1578.33 EUR.

What is Portfolio Composition?

The portfolio composition is represented in a pie chart that reflects the positions relative to all positions in the algorithm portfolio.

The total portfolio of this bot (100%) is composed of 70.9% EUR (Euro), 15.7% ADA (Cardano), 13,4% ETH (Ethereum) and 0% each of BTC (Bitcoin) and DOT (Polkadot).

Next, learn about orders on Finterion.