Positions

A position is the amount of an asset that is owned. When a bot, on behalf of the investor, makes a buy or sell order, they take a position.

There are three main types of positions:

- Long positions: Involves owning an asset. Long positions gain when there is an increase in price and lose when there is a decrease.

- Short positions: Profit when underlying asset price falls. This often involves assets that are borrowed and then sold, in the hope of being able to buy it back at a lower price.

- Neutral positions: This position does not change much in value, if the price of the underlying asset rises or falls. Instead, neutral positions profit or loss based on other factors such as changing interest rates, volatility or exchange rates.

The position sizing is the size of a position within a particular portfolio or the value in trading currency is bot trades. Factors such as account size and risk tolerance should be considered when defining the appropriate position sizing.

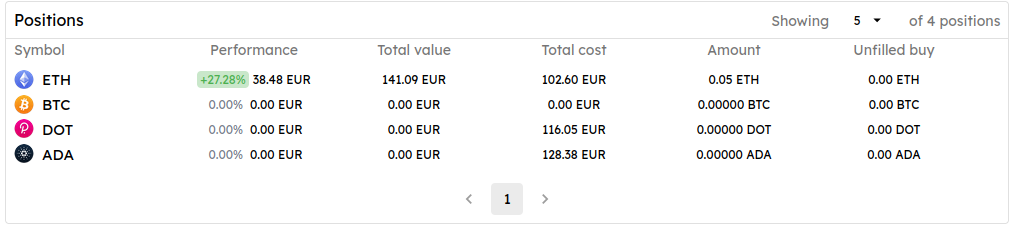

We will use an example position overview to explain how to interpret the different datapoints. The example will be highlighted in the notes section, like this. The example data does not represent all positions on Finterion, it is simply an example for this tutorial.

Positions on Algorithm Page

On the algorithm page you can see the current positions of the bot. You can see the traded asset, performance, total value of the position, amount of the asset, and unfulfilled buy orders.

-

Traded Asset: This refers to the specific asset that you have bought or sold. In the context of your portfolio, it could be a variety of cryptocurrencies like Ethereum (ETH), Bitcoin (BTC), Polkadot (DOT), or Cardano (ADA).

-

Performance: This is a measure of how well your asset is doing. It is usually expressed as a percentage change in the value of the asset over a certain period of time. A positive performance indicates that the value of the asset has increased, while a negative performance indicates a decrease in value.

-

Total Value of the Position: This is the current market value of your holdings in a particular asset. It is calculated by multiplying the current price of the asset by the quantity of the asset you own.

-

Amount of the Asset: This is the quantity of the asset that you currently own in your portfolio. For cryptocurrencies, this could be a certain number of coins or tokens.

-

Unfulfilled Buy Orders: These are orders that the bot has placed to buy more of a certain asset, but which have not been completed yet. This could be because the market price has not reached your specified buy price, or because there is not enough of the assets available to fulfill your order at the current time.

Currently this bot has positions in four different cryptocurrencies: Ethereum (ETH), Bitcoin (BTC), Polkadot (DOT), and Cardano (ADA).

-

Ethereum (ETH): This bot has a positive performance of +27.28%. The total value of your ETH holdings is 38.48 EUR, which came at a cost of 141.09 EUR. The amount of ETH this owns is equivalent to 102.60 EUR. There is an unfilled buy order for 0.05 ETH and no unfilled sell orders.

-

Bitcoin (BTC): Currently, this bot does not have any BTC holdings, hence the performance, total value, total cost, and amount are all 0.00 EUR. There are no unfilled buy or sell orders for BTC.

-

Polkadot (DOT): Similar to BTC, you do not have any DOT holdings. The total cost for DOT was 116.05 EUR. The current total position value is 0.00 EUR. There are no unfilled buy or sell orders for DOT.

-

Cardano (ADA): This bot currently does not have any ADA holdings. The total cost for ADA was 128.38 EUR. The current total position value is 0.00 EUR. There are no unfilled buy or sell orders for ADA.

Next, learn about portfolios.